Privacy

Big Dipper Insurance Brokers (INDIA) Private Limited is committed to maintain the confidentiality, integrity and security of all information of our users. The information is used in connection with the services offered through our Website and relevant information shared with our authorized business partners only for the purpose of policy solicitation process, pre/post-sale servicing, claim servicing and providing you any other services as permissible under applicable laws. This Privacy Policy applies to current and former visitors to our Website and our customers.

This Privacy Policy is published in compliance of: the Information Technology Act, 2000; and the Information Technology (Reasonable Security Practices and Procedures and Sensitive Personal Information) Rules, 2011 (the "SPDI Rules") as amended from time to time.

Interpretation and Definitions

Interpretation

The following definitions shall have the same meaning regardless of whether they appear in singular or in plural.

Definitions

For the purposes of this Privacy Policy:

Account means a unique account created for You to access our Service or parts of our Service.

Affiliate means an entity that controls, is controlled by or is under common control with a party, where "control" means ownership of 50% or more of the shares, equity interest or other securities entitled to vote for election of directors or other managing authority.

Application means the software program provided by the Company downloaded by You on any electronic device, named Apnareward

Company (referred to as either "the Company", "We", "Us" or "Our" in this Agreement) refers to BIG DIPPER Insurance Brokers INDIA Private Limited

Country refers to: India

Device means any device that can access the Service such as a computer, a cell phone or a digital tablet.

Personal Data is any information that relates to an identified or identifiable individual.

Service refers to the Application.

Service Provider means any natural or legal person who processes the data on behalf of the Company. It refers to third-party companies or individuals employed by the Company to facilitate the Service, to provide the Service on behalf of the Company, to perform services related to the Service or to assist the Company in analyzing how the Service is used.

Usage Data refers to data collected automatically, either generated by the use of the Service or from the Service infrastructure itself (for example, the duration of a page visit).

You means the individual accessing or using the Service, or the company, or other legal entity on behalf of which such individual is accessing or using the Service, as applicable.

Preamble

Preamble These general conditions of use (hereinafter referred to as “Terms”) are intended to define the relationship between the User (hereinafter referred to as the “User”or “you” or “Your” or “customer” or “assured” or “insured” or “member”) and BIGDIPPERINSURANCE.COM (hereinafter called the “we” or “our” or “BIG DIPPER” or “BDIB”) which offers the General Insurance Broking Service such as online purchase of Motor and Health Insurance Policies on and through site https://www.bigdipperinsurance.com (hereinafter the “Website” or “Site” or “Resources”).

Description of Services

In the Site / Mobile Application, BIG DIPPER Insurance Brokers (INDIA) Private Limited provides users with access to information primarily about General Insurance products and services including but not restricted to General Insurance including Health Insurance products and related services (including but not limited to renewals) (the "Service"). You are responsible for obtaining access to the Site / Mobile Application, and that access may involve third-party fees (such as Internet service provider or airtime charges). In addition, you must provide and are responsible for all equipment necessary to access the Site / Mobile Application. By making use of this Site / Mobile Application, and furnishing your personal / contact details, you hereby agree that you are interested in availing and purchasing the Service(s) that you have selected.

Global Acceptance of Terms

The connection to or use of the Website whose URL is: https://www.bigdipperinsurance.com remains subject to the full and unconditional acceptance of the User of these Terms of which he was able, prior, to read and respect. The acceptance of these Terms is comprehensive and applies to all provisions therein presented. The User is informed that these Terms of Website may be changed at any time and without delay or notice. The new version will be available upon change. It is therefore advised to regularly consult the latest version of the Terms of Use on the Website. Users are also advised of the possibility of change in the url of this page, without prior notification.

Who we are

We, BIG DIPPER Insurance Brokers (INDIA) Private Limited (BDIB or BIG DIPPER) having website of https://www.bigdipperinsurance.com to provide consumers choice and an easy way to buy Insurance products from multiple Insurance companies. BDIB is not an insurance company. BDIB is a licensed as Direct General Insurance Broking Company holding a Certificate of Registration Code as IRDAI DB/981/22 and Broking licence Registration Number is 880 from the Indian Insurance Regulator – Insurance Regulatory and Development authority of INDIA.

Our participating insurance providers supply some of the information available on the Website and therefore there may be inaccuracies in the Website Information over which BIG DIPPER has limited control.

BIG DIPPER does not warrant or guarantee the Timeliness, accuracy or completeness of the Website Information; or Quality of the results obtained from the use of the Website.

To the maximum extent permitted by law, BIG DIPPER has no liability in relation to or arising out of the Website Information and Website recommendations. You are responsible for the final choice of your product and you should take time to read through all information supplied before proceeding. If you are in any doubt regarding a product or its terms you should seek further advice from BIG DIPPER or the relevant participating provider before choosing your product. You are responsible to read and understand all Document (s), Exclusion (s), Warranty (ies), Premium Payment Warranty, Compliance of 64VB, Terms and Conditions of Original Policy or Quotation.

BIG DIPPER may pass on your personal information to the relevant participating provider if you apply to purchase a product through https://www.bigdipperinsurance.com, however, BIG DIPPER does not guarantee when or if you will actually acquire the product that you have chosen. BIG DIPPER does not accept any liability arising out of circumstances where there is delay in you acquiring the product you have chosen.

Please note that BIG DIPPER is only collecting or assisting in collecting the premium deposit on behalf of the insurer you have chosen to buy the policy. The acceptance of the deposit as premium and final issuance of the policy is subject to the underwriting norms and discretion of the Insurer whose policy you have chosen to buy on which BIG DIPPER has no control. BIG DIPPER will ensure that the amount is refunded by the insurer in case there is no ultimate issuance of policy.

By visiting our website and accessing the information, resources, services, products, and tools we provide, you understand and agree to accept and adhere to the following terms and conditions as stated in this policy (hereafter referred to as ‘User Agreement’), along with the terms and conditions as stated in our Privacy Policy (please refer to the Privacy Policy section below for more information).

We reserve the right to change this User Agreement from time to time without notice. You acknowledge and agree that it is your responsibility to review this User Agreement periodically to familiarize yourself with any modifications. Your continued use of this site after such modifications will constitute acknowledgment and agreement of the modified terms and conditions.

Member Eligibility

The Services are available only to individuals who can form legally binding contracts under applicable law. Without limiting the foregoing, the Services are not permitted to be used by minors (which means, in most jurisdictions, those under the age of 18) or temporarily or indefinitely suspended BIGDIPPERINSURANCE.COM members. In addition, BIGDIPPERINSURANCE.COM does not permit use of the Services by residents

- of any jurisdiction that may prohibit our Services or

- of any country that are prohibited by law, regulation, court orders, sanctions, treaty or administrative act from entering into trade relations. If you do not qualify, please do not use the Services

- risks domiciled out side INDIA Jurisdiction unless SAARC Country IMT endorsement if applicable as per India Motor Act.

- domiciled in the Republic of India for Health Insurance

Children's Privacy

Our Service does not address anyone under the age of 18. We do not knowingly collect personally identifiable information from anyone under the age of 18. If you are a parent or guardian and you are aware that your child has provided Us with Personal Data, please contact Us. If we become aware that we have collected Personal Data from anyone under the age of 18 without verification of parental consent, we take steps to remove that information from our servers.

If we need to rely on consent as a legal basis for processing Your information and Your country requires consent from a parent, We may require Your parent's consent before We collect and use that information.

What we collect

Online form per product mentioned on the website. While using Our Service, We may ask You to provide Us with certain personally identifiable information that can be used to contact or identify You. Personally identifiable information may include, but is not limited to as below para:

You provide us and we collect personal information including your name, gender, birth information, mobile number, email ID, PAN Card, Adhaar Card, Photo, your nominee details, family details for Family Floater Health Insurance, Vehicle All Specifications with Registration Details and residence address etc. This information is used to calculate your Insurance Premium based on your selection of coverages. All together we secure your details and provide this to Insurance companies upon your selection of Insurance by your choice.

Payment and billing information: We might collect your billing name, billing address and payment method . We NEVER collect your credit card number or card expiry date or other details pertaining to your credit card on our website.

Usage Data

Usage Data is collected automatically when using the Service.

Usage Data may include information such as Your Device's Internet Protocol address (e.g. IP address), browser type, browser version, the pages of our Service that You visit, the time and date of Your visit, the time spent on those pages, unique device identifiers and other diagnostic data.

When You access the Service by or through a mobile device, We may collect certain information automatically, including, but not limited to, the type of mobile device You use, Your mobile device unique ID, the IP address of Your mobile device, Your mobile operating system, the type of mobile Internet browser You use, unique device identifiers and other diagnostic data.

We may also collect information that your browser sends whenever You visit our Service or when You access the Service by or through a mobile device.

Information Collected while Using the Application

While using Our Application, in order to provide features of Our Application, We may collect, with your prior permission:

Information from your Device's phone book (contacts list)

We use this information to provide features of Our Service, to improve and customize Our Service. The information may be uploaded to the Company's servers and/or a Service Provider's server or it may be simply stored on your device.

You can enable or disable access to this information at any time, through Your Device settings.

We Collect Cookies

A cookie is a piece of data stored on the user's computer tied to information about the user. We may use both session ID cookies and persistent cookies. For session ID cookies, once you close your browser or log out, the cookie terminates and is erased. A persistent cookie is a small text file stored on your computer’s hard drive for an extended period of time. Session ID cookies may be used by PRP to track user preferences while the user is visiting the website. They also help to minimize load times and save on server processing. Persistent cookies may be used by PRP to store whether, for example, you want your password remembered or not, and other information. Cookies used on the PRP website do not contain personally identifiable information.

Log Files

Like most standard websites, we use log files. This information may include internet protocol (IP) addresses, browser type, internet service provider (ISP), referring/exit pages, platform type, date/time stamp, and number of clicks to analyze trends, administer the site, track user's movement in the aggregate, and gather broad demographic information for aggregate use. We may combine this automatically collected log information with other information we collect about you. We do this to improve services we offer to you, to improve marketing, analytics or site functionality.

Email- Opt out

If you are no longer interested in receiving e-mail announcements and other marketing information from us, please e-mail your request at: [email protected]. Please note that it may take about 10 days to process your request.

Copyrights/Trademarks

All content and materials available on https://www.bigdipperinsurance.com/, including but not limited to text, graphics, website name, code, images and logos are the intellectual property of BIG DIPPER Insurance Brokers (INDIA) Private Limited, and are protected by applicable copyright and trademark law. Any inappropriate use, including but not limited to the reproduction, distribution, display or transmission of any content on this site is strictly prohibited, unless specifically authorized by BIG DIPPER Insurance Brokers (INDIA) Private Limited

Responsible Use and Conduct

By visiting our website and accessing the information, resources, services, products, and tools we provide for you, either directly or indirectly (hereafter referred to as ‘Resources’), you agree to use these Resources only for the purposes intended as permitted by (a) the terms of this User Agreement, and (b) applicable laws, regulations and generally accepted online practices or guidelines.

Wherein, you understand that:

- In order to access our Resources, you may be required to provide certain information about yourself (such as identification, contact details, etc.) as part of the registration process, or as part of your ability to use the Resources as mentioned above under ‘What we collect’. You agree that any information you provide will always be accurate, correct, and up to date.

- You are responsible for maintaining the confidentiality of any login information associated with any account you use to access our Resources. Accordingly, you are responsible for all activities that occur under your account/s or filled form Insurance purchase or buying.

- Accessing (or attempting to access) any of our Resources by any means other than through the means we provide, is strictly prohibited. You specifically agree not to access (or attempt to access) any of our Resources through any automated, unethical or unconventional means.

- Engaging in any activity that disrupts or interferes with our Resources, including the servers and/or networks to which our Resources are located or connected, is strictly prohibited.

- To share some information (other than your personal information like your name, address, email address or telephone number) with third-party advertising companies and/or ad agencies to serve ads when you visit our Web site.

- Attempting to copy, duplicate, reproduce, sell, trade, or resell our Resources is strictly prohibited.

- You are solely responsible any consequences, losses, or damages that we may directly or indirectly incur or suffer due to any unauthorized activities conducted by you, as explained above, and may incur criminal or civil liability.

-

We may provide various open communication tools on our website, such as blog comments, blog

posts, public chat, forums, message boards, newsgroups, product ratings and reviews, various

social media services, etc. You understand that generally we do not pre-screen or monitor the

content posted by users of these various communication tools, which means that if you choose to

use these tools to submit any type of content to our website, then it is your personal

responsibility to use these tools in a responsible and ethical manner. By posting information or

otherwise using any open communication tools as mentioned, you agree that you will not upload,

post, share, or otherwise distribute any content that:

- Is illegal, threatening, defamatory, abusive, harassing, degrading, intimidating, fraudulent, deceptive, invasive, racist, or contains any type of suggestive, inappropriate, or explicit language;

- Infringes on any trademark, patent, trade secret, copyright, or other proprietary right of any party;

- Contains any type of unauthorized or unsolicited advertising;

- Impersonates any person or entity, including any https://www.bigdipperinsurance.com/ employees or representatives.

- We do not assume any liability for any content posted by you or any other 3rd party users of our website. However, any content posted by you using any open communication tools on our website, provided that it doesn’t violate or infringe on any 3rd party copyrights or trademarks, becomes the property of BIG DIPPER Insurance Brokers (INDIA) Private Limited, and as such, gives us a perpetual, irrevocable, worldwide, royalty-free, exclusive license to reproduce, modify, adapt, translate, publish, publicly display and/or distribute as we see fit. This only refers and applies to content posted via open communication tools as described, and does not refer to information that is provided as part of the registration process, necessary in order to use our Resources. All information provided as part of our registration process is covered by our privacy policy.

Additional Terms and Conditions you shall follow:

- You agree to follow THE INSURANCE ACT, 1938 (Incorporating all amendments including the amendment by the Insurance (Amendment) Act, 2021) Section 41. Prohibition of rebates. — (1) No person shall allow or offer to allow, either directly or indirectly, as an inducement to any person to 2 [take out or renew or continue] an insurance in respect of any kind of risk relating to lives or property in India, any rebate of the whole or part of the commission payable or any rebate of the premium shown on the policy, nor shall any person taking out or renewing 3 [or continuing] a policy accept any rebate, except such rebate as may be allowed in accordance with the published prospectuses or tables of the insurer: 2 [Provided that acceptance by an insurance agent of commission in connection with a policy of life insurance taken out by himself on his own life shall not be deemed to be acceptance of a rebate of premium within the meaning of this sub-section if at the time of such acceptance the insurance agent satisfies the prescribed conditions establishing that he is a bona fide insurance agent employed by the insurer.] 4 [(2) Any person making default in complying with the provisions of this section shall be liable for a penalty which may extend to ten lakh rupees.]

- You agree to follow THE INSURANCE ACT, 1938 (Incorporating all amendments including the amendment by the Insurance (Amendment) Act, 2021) Section 64VB. No risk to be assumed unless premium is received in advance.—(1) No insurer shall assume any risk in India in respect of any insurance business on which premium is not ordinarily payable outside India unless and until the premium payable is received by him or is guaranteed to be paid by such person in such manner and within such time as may be prescribed or unless and until deposit of such amount as may be prescribed, is made in advance in the prescribed manner. (2) For the purposes of this section, in the case of risks for which premium can be ascertained in advance, the risk may be assumed not earlier than the date on which the premium has been paid in cash or by cheque to the insurer. Explanation. —Where the premium is tendered by postal money order or cheque sent by post, the risk may be assumed on the date on which the money order is booked or the cheque is posted, as the case may be. (3) Any refund of premium which may become due to an insured on account of the cancellation of a policy or alteration in its terms and conditions or otherwise shall be paid by the insurer directly to the insured by a crossed or order cheque or by postal money order and a proper receipt shall be obtained by the insurer from the insured, and such refund shall in no case be credited to the account of the agent. (4) Where an insurance agent collects a premium on a policy of insurance on behalf of an insurer, he shall deposit with, or dispatch by post to, the insurer, the premium so collected in full without deduction of his commission within twenty-four hours of the collection excluding bank and postal holidays. (5) The Central Government may, by rules, relax the requirements of sub-section (1) in respect of particular categories in insurance policies. 1 [(6) The Authority may, from time to time, specify, by the regulations made by it, the manner of receipt of premium by the insurer.]

- Material Facts: It is your duty to disclose on material facts to Insurer (insurance Company) through BIG DIPPER. Neither we nor the Insurance Company is obliged to make enquiry (ies) and you must disclose all material information to Insurance Company (ies) or service provider before the contract is concluded, at the time of any variation of the contract and upon renewal. You must also advice us of any such facts or changes to such facts during the currency of the contract, as these may also need to disclose. A material fact is a fact which may influence an Insurance Company (ies) or service provider judgement in their assessment of a risk, including its terms and pricing. If you are in any doubt as to whether a fact is material, we recommend that it be disclosed. Failure to disclose material facts may entitle Insurance Companies or Insurance Company or service provider to avoid the contract or insurance policy from inception.

- Warranties: BIG DIPPER would draw your attention to any warranty (ies) detailed in quotation or policy schedule or endorsement in this contract. Any breach of a warranty or warranties may prejudice your rights under the contract and may entitle Insurance Company or Insurance Companies or service provider to terminate the contract or Insurance Policy from the date of that breach or in some instances, from inception. Please note that warranties may exist in the contract i.e. insurance policy using other terminology and without reference to the word “warranty”.

- Conditions Precedent: Please take particular note of any conditions precedent that appear in a contract. If a condition precedent to the validity of this contract or insurance policy or the commencement of the risk is not complied with, the insurance company or service provider will not come on risk. If a condition precedent to the Insurance Company (ies) or service provider liability under this contract is not complied with, the insurance company will not be liable for the loss. A condition precedent may exist in the contract using other terminology and with out reference to the words “conditions precedent”.

-

You further declare that you will notify in writing any change occurring in the occupation or

general health of the life to be insured/proposer after the proposal has been submitted but

before communication of the risk acceptance by the insurance company. You declare full

information about your past medical history i.e. preexisting diseases / Surgery (ies) etc,

habits such as smoking, drinking etc. Further, you also confirm that you agree to the waiting

period if any for the pre-existing diseases etc if incorporated by Insurance Company or service

provider.

You declare that you consent to the insurance company seeking medical information from any doctor or hospital who/which at any time has attended on the person to be insured/proposer or from any past or present employer concerning anything which affects the physical or mental health of the person to be insured/proposer and seeking information from any insurer to whom an application for insurance on the person to be insured/proposer has been made for the purpose of underwriting the proposal and/or claim settlement. Here the insurance company may be using Third Party Administration Services which are known as TPAs and Medical Assistance who provide assistance to Insurance company for the claims management. It is your responsibility to check your cumulative bonus (after claim and also for claims free year) and you shall approach us in timely manner for any endorsement for inclusion of new additions in your family such as after marriage or new baby born as per the Insurance Companies terms and conditions. You shall read and agree all the documents such as quotations, coverages, definitions, exclusions, epidemic & pandemic, CDE exclusions, conditions, list of hospitals in network, limits, benefits coverage, warranties, addon coverages, endorsements, pre-existing, pro & post admission, per claim definition, out and in patience definitions before the purchase and after the purchase of the Health Product.

You authorize the BIG DIPPER/insurance company to share information pertaining to your proposal including the medical records of the insured/ proposer for the sole purpose of underwriting the proposal and/or claims settlement and with any Governmental and/or Regulatory authority. This is not limited but including Health Insurance Products and Motor Insurance Products. -

You further declare that you have fill the Motor Insurance proposal form with full details and

complete true material facts including all details but not limited to vehicles details such as:

- Fuel,

- Seating Capacity,

- Make,

- Model including Variant,

- Registration Number,

- Your expiring policy details which you have already availed for immediate last 12 months (i.e. 365 days or full one year preceding year on renewal date) till this policy’s inception date of BIG DIPPER online portal,

- Your Loss Record for immediate preceding 12 months on renewal date,

- Area of Use (for Commercial vehicles – Permits),

- Purpose of Use,

- Cubic Capacity or Gross Weight Tonnage etc

- Add On Benefits,

- Any discounts on Own Damage Section of Motor Insurance Policy as per IMT (India Motor Tariff) or Insurance Act 1938 Incorporating all amendments including the amendment by the Insurance (Amendment) Act, 2021),

- Your confirmation on No Claim Bonus Declaration percentile or amount of discount or

incentives stands correct and further you declare that there are no claims outstanding

or reported or pending or Incurred but Not Enough Reported to Insurance Company or Us.

As per India Motor Tariff and India Motor Act applicable. You also confirm the below

paragraph which is already forming part of our form to fill under GET A QUOTE:

"I / We declare that the rate of NCB claimed by me/us is correct and that no claim as arisen in the expiring policy period (copy of the policy enclosed). I/We further undertake that if this declaration is found to be incorrect, all benefits under the policy in respect of Section I of the Policy will stand forfeited. " - Engine Number,

- Chassis Number as per Government Authority that is RTO/RTA Record i.e. RC Book, are correct as per your knowledge & actual record.

- If you have NCB Reservation Letter from foreign country, employee (dedicated driver to vehicle with organisation), your last insurer which was within three years from you sale your last vehicle and NCB is reserved, even in case of transfer of NCB due to death of Policyholder who was eligible and already enjoyed NCB such cases you shall approach physically to our offices for insurance purchase on Motor Class. Please refer India Motor Tariff and India Motor Act.

- You require to prove NCB entitlement during renewal. Onus of Proof is on you. We make

you aware that NCB (no claim bonus on Own Damage for Motor Class) is availed after 12

months availing of last or expiring policy period. The vehicle and policy should be on

your name with no claims reported and pending on Own Damage or Third Party Claims, for

last full 12 months or throughout during the policy period. Please refer point l) and o)

above. Thus, during the year if Assignor transfers his vehicle to Assignee, the policy

or New User (assignee) who has not used the vehicle for the past 12 months & there is no

NCB entitlement on record on Assignee’s name or not availed by Assignee his 12 months of

loss free Motor Insurance Policy Period on Standalone Own Damage Section / Comprehensive

Policy or Assignee is not meeting as per point l) & o) which means the above points l) &

o) are not fulfilled as above, then there shall be No NCB applicable. So it is your duty

to declare correct NCB and facts on NCB to BIG DIPPER in advance before you purchase of

Insurance on Online. As per India Motor Tariff and India Motor Act are applicable.

Please read the below paras on No Claim Bonus as per IMT.

- GR.27. No Claim Bonus

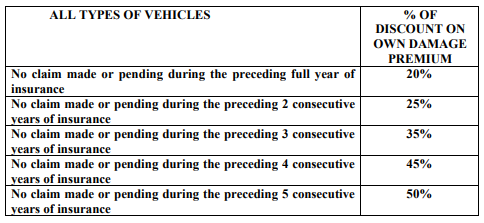

No Claim Bonus(NCB) can be earned only in the Own Damage section of Policies covering all classes of vehicles but not on Motor Trade Policies (Road Transit Risks / Road Risks / Internal Risks) and policies which cover only Fire and / or Theft Risks. For policies covering Liability with Fire and/or Theft Risks, the NCB will be applicable only on the Fire and / or Theft components of the premium. An insured becomes entitled to NCB only at the renewal of a policy after the expiry of the full duration of 12 months. - No Claim Bonus, wherever applicable, will be as per the following table.

Sunset Clause: If at the renewal falling due any time between 1st July 2002 and 30th June 2003, both days inclusive, (after completion of the full policy period of 12 months) an insured becomes entitled to an NCB of 55% or 65% in terms of the Tariff prevailing prior to 1st July 2002, the entitlement of such higher percentage of NCB will remain protected for all subsequent renewals till a claim arises under the policy, in which case the NCB will revert to „Nil‟ at the next renewal. Thereafter, NCB if any earned, will be in terms of the above table. - The percentage of applicable NCB is to be computed on the Own Damage premium required for renewal of the insurance after deducting any rebate in respect of "Vehicle Laid Up" under the policy. If the policy period has been extended in lieu of the rebate for the lay up of the vehicle, as per „Vehicle Laid Up‟ Regulation, such extended period shall be deemed to have been part of the preceding year of insurance.

- The entitlement of NCB shall follow the fortune of the original insured and not

the vehicle or the policy. In the event of transfer of interest in the policy

from one insured to another, the entitlement of NCB for the new insured will be

as per the transferee‟s eligibility following the transfer of interest.

It is however, clarified that the entitlement of No Claim Bonus will be applicable for the substituted vehicle subject to the provision that the substituted vehicle on which the entitled NCB is to be applied is of the same class (as per this tariff) as the vehicle on which the NCB has been earned.

Provided that where the insured is an individual, and on his/ her death the custody and use of the vehicle pass to his/her spouse and/or children and/or parents, the NCB entitlement of the original insured will pass on to such person/s to whom the custody and use of the vehicle pass. - The percentage of NCB earned on a vehicle owned by an institution during the period when it was allotted to and exclusively operated by an employee should be passed on to the employee if the ownership of the vehicle is transferred in the name of the employee. This will however require submission of a suitable letter from the employer confirming that prior to transfer of ownership of the vehicle to the employee, it was allotted to and exclusively operated by the employee during the period in which the NCB was earned.

-

In the event of the insured, transferring his insurance from one insurer to

another insurer, the transferee insurer may allow the same rate of NCB which the

insured would have received from the previous insurer. Evidence of the insured's

NCB entitlement either in the form of a renewal notice or a letter confirming

the NCB entitlement from the previous insurer will be required for this purpose.

13 Where the insured is unable to produce such evidence of NCB entitlement from

the previous insurer, the claimed NCB may be permitted after obtaining from the

insured a declaration as per the following wording:

“I / We declare that the rate of NCB claimed by me/us is correct and that no claim as arisen in the expiring policy period (copy of the policy enclosed). I/We further undertake that if this declaration is found to be incorrect, all benefits under the policy in respect of Section I of the Policy will stand forfeited.”

Notwithstanding the above declaration, the insurer allowing the NCB will be obliged to write to the policy issuing office of the previous insurer by recorded delivery calling for confirmation of the entitlement and rate of NCB for the particular insured and the previous insurer shall be obliged to provide the information sought within 30 days of receipt of the letter of enquiry failing which the matter will be treated as a breach of Tariff on the part of the previous insurer. Failure of the insurer granting the NCB to write to the previous insurer within 21 days after granting the cover will also constitute a breach of the Tariff. - If an insured vehicle is sold and not replaced immediately, or laid up, and the policy is not renewed immediately after expiry, NCB, if any, may be granted on a subsequent insurance, provided such fresh insurance is effected within 3 (three) years from the expiry of the previous insurance. The rate of NCB applicable to the fresh policy shall be that earned at the expiry of the last 12 months period of insurance.

- On production of evidence of having earned NCB abroad, an insured may be granted NCB on a new policy taken out in India as per entitlement earned abroad, provided the policy is taken out in India within three years of expiry of the overseas insurance policy, subject to relevant provisions of NCB under these rules.

- Except as provided in Rule (g), no NCB can be allowed when a policy is not renewed within 90 days of its expiry.

- Except as provided in Rules (g), (h) and (i) above, NCB is to be allowed only when the vehicle has been insured continuously for a period of 12 months without any break.

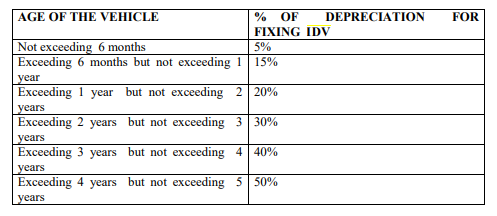

- Insured Declared Value is arrived as per the following: You are responsible for the correctness of IDV.

- GR.27. No Claim Bonus

GR.9. SCHEDULE OF DEPRECIATION FOR ARRIVING AT IDV

NOTE: IDV of vehicles beyond 5 years of age and of obsolete models of the vehicles ( i.e. models which the manufacturers have discontinued to manufacture) is to be determined on the basis of an understanding between the insurer and the insured. IDV shall be treated as the „Market Value‟ throughout the policy period without any further depreciation for the purpose of Total Loss(TL)/ Constructive Total Loss(CTL) claims. For the purpose of TL/CTL claim settlement this IDV will not change during the currency of the policy period in question. It is clearly understood that the liability of the insurer shall in no case exceed the IDV as specified in the policy schedule less the value of the wreck, in 'as is where is' condition

Links to Other Websites

Our Service may contain links to other websites that are not operated by us. If you click on a third party link, you will be directed to that third party's site. We strongly advise you to review the Privacy Policy of every site you visit.

We have no control over and assume no responsibility for the content, privacy policies or practices of any third party sites or services. Therefore, we cannot be responsible for the protection and privacy of any information which you provide whilst visiting such sites and such sites are not governed by this privacy statement. You should exercise caution and look at the privacy statement applicable to the website in question.

Changes to this Privacy Policy

We may update Our Privacy Policy from time to time. We will notify you of any changes by posting the new Privacy Policy on this page.

We will let you know via email and/or a prominent notice on Our Service, prior to the change becoming effective and update the "Last updated" date at the top of this Privacy Policy.

You are advised to review this Privacy Policy periodically for any changes. Changes to this Privacy Policy are effective when they are posted on this page.

Limitation of Warranties

By using our website, you understand and agree that all Resources we provide are “as is” and “as available”. This means that we do not represent or warrant to you that:

- The use of our Resources will meet your needs or requirements.

- The use of our Resources will be uninterrupted, timely, secure or free from errors.

- The information obtained by using our Resources will be accurate or reliable, and

- Any defects in the operation or functionality of any Resources we provide will be repaired or corrected.

Furthermore, you understand and agree that:

- Any content downloaded or otherwise obtained through the use of our Resources is done at your own discretion and risk, and that you are solely responsible for any damage to your computer or other devices for any loss of data that may result from the download of such content.

- No information or advice, whether expressed, implied, oral or written, obtained by you from BIG DIPPER Insurance Brokers (INDIA) Private Limited or through any Resources we provide shall create any warranty, guarantee, or conditions of any kind, except for those expressly outlined in this User Agreement.

Disclaimer of Liability and Warranty

The Content, Products, and Services Published on this Site / Mobile Application/ Resources may include inaccuracies or errors, Including Pricing errors. We do not guarantee the accuracy of and disclaim all liability for any errors or other inaccuracies relating to the information and description of the content, products, and services we expressly reserves the right to correct any pricing errors on the website (Site) / Mobile Application and/or on pending reservations made under an incorrect price. BIG DIPPER Insurance Brokers (INDIA) Private Limited makes no representation about the suitability of the information, Software, products, and services contained on this Website / Mobile Application/ Resources for any purpose, and the inclusion or offering of any products or services on this Site / Mobile Application does not constitute any endorsement or recommendation of such products or services. All such information, software, products, and services are provided "AS IS" without warranty of any kind. BIG DIPPER Insurance Brokers (INDIA) Private Limited disclaims all warranties and conditions that this Site / Mobile Application/ Resources, its services or any email sent from BIG DIPPER Insurance Brokers (INDIA) Private Limited, its affiliates, and/or their respective or associated service providers are free of viruses or other harmful components. BIG DIPPER Insurance Brokers (INDIA) Private Limited hereby disclaims all warranties and conditions with regard to this information, software, resources, products, and services, including all implied warranties and conditions of merchantability, fitness for a particular purpose, title, and no infringement. The service providers providing services on this Site / Mobile Application/ Resources are independent affiliates and BIG DIPPER Insurance Brokers (INDIA) Private Limited are not liable for the acts, errors, omissions, representations, warranties, breaches or negligence of any such service providers or for any personal injuries, death, property damage, or other damages or expenses resulting therefore. BIG DIPPER Insurance Brokers (INDIA) Private Limited and its affiliates have no liability and will make no refund in the event of any delay, cancellation, strike, force majeure or other causes beyond their direct control, and they have no responsibility for any additional expense omissions delays or acts of any government or authority. In no event shall BIG DIPPER Insurance Brokers (INDIA) Private Limited and/or its affiliates be liable for any direct, indirect, punitive, incidental, special, or consequential damages arising out of, or in any way connected with, your access to, display of or use of this Site / Mobile Application or resources or with the delay or inability to access, display or use this Site / Mobile Application (including, but not limited to, your reliance upon opinions appearing on this Site / Mobile Application; any computer viruses, information, software, linked sites, products, and services obtained through this Site / Mobile Application/ Resources; or otherwise arising out of the access to, downtime, display of or use of this Site / Mobile Application) or resources whether based on a theory of negligence, contract, tort, strict liability, or otherwise, and even if BIG DIPPER Insurance Brokers (INDIA) Private Limited and/or its affiliates their respective service providers have been advised of the possibility of such damages.

Limitation of Liability

You expressly understand and agree that BIG DIPPER and its subsidiaries, affiliates, officers, BQPs, employees, PoSP, agents, partners and licensors shall not be liable to you for any direct, indirect, incidental, special, consequntial or exemplary damages, including, but not limited to, damages for loss of profits, goodwill, use, data or other intangible losses (even if BIG DIPPER has been advised of the possibility of such damages), resulting from use of the Website (Site) / Mobile Application/ Resources, content or any related services. If, despite the limitation above, BIG DIPPER or its Affiliates are found liable for any loss or damage which arises out of or in any way connected with any of the occurrences described above, then the liability of BIG DIPPER and/or Its Affiliates will in no event exceed, in the aggregate, the greater of (a) the service fees you paid to BIG DIPPER in connection with such transaction(s) on this Site / Mobile Application/ Resources, or (b) Rupees One Hundred only (INR 100) The limitation of liability reflects the allocation of risk between the parties. The limitations specified in this section will survive and apply even if any limited remedy specified in these terms is found to have failed of its essential purpose. The limitations of liability provided in these terms inure to the benefit of BIG DIPPER, Its affiliates, and/or their respective service providers.

Indemnity

You agree to indemnify and hold BIG DIPPER (and its officers, BQP, directors, PoSP, agents, subsidiaries, joint ventures, and employees) harmless from any and against any claims, causes of action, demands, recoveries, losses, damages, fines, penalties or other costs or expenses of any kind or nature, including reasonable attorneys' fees, or arising out of or related to your breach of this ToU, your violation of any law or the rights of a third party, or your use of the Site / Mobile Application/ Resources. We reserve the right to take over the exclusive defence of any claim for which we are entitled to indemnification under this User Agreement. In such event, you shall provide us with such cooperation as is reasonably requested by us.

Termination of Use

You agree that we may, at our sole discretion, suspend or terminate your access to all or part of our website and Resources with or without notice and for any reason, including, without limitation, breach of this User Agreement. Any suspected illegal, fraudulent or abusive activity may be grounds for terminating your relationship and may be referred to appropriate law enforcement authorities. Upon suspension or termination, your right to use the Resources we provide will immediately cease, and we reserve the right to remove or delete any information that you may have on file with us, including any account or login information.

Governing Law

This website is controlled by BIG DIPPER Insurance Brokers (INDIA) Private Limited from our offices located in the state of Maharashtra, INDIA. It can be accessed by most countries around the world. As each country has laws that may differ from those of the Republic of INDIA, by accessing our website, you agree that the statutes and laws of the Republic of INDIA, without regard to the conflict of laws and the United Nations Convention on the International Sales of Goods, including AML compliance and LMA 3100 i.e. Sanction Clause will apply to all matters relating to the use of this website and the purchase of any products or services through this site.

Furthermore, any action to enforce this User Agreement shall be brought in the federal or state courts located in India. You hereby agree to personal jurisdiction by such courts, and waive any jurisdictional, venue, or inconvenient forum objections to such courts.

Guarantee

UNLESS OTHERWISE EXPRESSED, BIG DIPPER INSURANCE BROKERS (INDIA) PRIVATE LIMITED EXPRESSLY DISCLAIMS ALL WARRANTIES AND CONDITIONS OF ANY KIND, WHETHER EXPRESS OR IMPLIED, INCLUDING, BUT NOT LIMITED TO THE IMPLIED WARRANTIES AND CONDITIONS OF MERCHANTABILITY, FITNESS FOR A PARTICULAR PURPOSE AND NON-INFRINGEMENT.

Nominee Assistance Program

- BIG DIPPER Insurance Brokers (INDIA) Private Limited ("BDIB") has merely partnered with various third party experts in order to facilitate extended services to the users purchasing Term Insurance. The services provided by the third party(s) are provided by them in their capacity as an independent service provider(s). BDIB do not provide the services in any capacity whatsoever. BDIB do not endorse the services of the listed partners. BDIB shall not be liable for any payment obligation in relation to the services provided under the Nominee Assistance program.

- BDIB shall not be liable for any act(s)/omission(s) of the partners and/or any defect/deficiency in provision of the listed services including their refusal to provide the services. Any third party facility/offer(s)/service(s)/product(s) (“offer”) shall be subject to the terms and conditions of such third party which shall be applicable to the user. BDIB do not endorse, make no representation and shall have no liability or obligation whatsoever in relation to such third party offer.

- All such third party offer shall be availed by user at their own risk and responsibility. BDIB shall not be liable for any payment obligation in relation to such third party offer, which shall be user's responsibility.

- BDIB is only an insurance broker and can assist with any insurance claims only to the extent of liasioning with the insurance company. Any insurance claim shall be processed by the insurance company subject to their terms and conditions and the insurance policy.

- BDIB reserves the sole right to modify, amend, change, refuse or revoke their respective services, any offers including third party offer herein at any time without assigning any reason and without any liability and notice.

- These terms and conditions for Nominee Assistance Program are in addition to all other terms and conditions provided hereunder including the FAQs and all these terms and conditions and FAQs are legally binding on the user. BDIB reserves the sole right to modify, amend, change or revoke these terms and conditions including the FAQs without any notice at any time and all such terms and conditions and FAQs as amended from time to time shall be legally binding on the user.

- Any disputes arising pursuant to these terms and conditions are subject to the exclusive jurisdiction of courts in Kolhapur.

Dispute Resolution

The Parties to this Agreement are committed to resolving all disputes arising under it (and whether such dispute arises before or after termination of this Agreement) without the need for litigation and to allow as far as possible for commercial relationships to remain unaffected by disputes and therefore the Parties:-

will attempt in good faith to resolve any dispute or claim promptly through negotiations between respective senior executives of the Parties who have authority to settle the same;

will attempt in good faith, if the matter is not resolved through negotiation within three months of the dispute arising, to resolve the dispute or claim through mediation with the assistance of a mediator agreed between the Parties or as recommended to the parties by the Centre for Dispute Resolution or such similar organisation as the Parties may agree; or The Republic of INDIA Law at Kolhapur Court

if the matter has not been resolved by mediation within six months of the dispute arising, or if either Party will not participate in a mediation procedure, the Parties will refer the dispute in accordance with the Jurisdiction and Choice of Law Clause below.

Notwithstanding the above, either Party may seek the immediate protection or assistance of the Kolhapur Courts if appropriate.

Jurisdiction and Choice of Law

This Agreement shall be construed according to the Republic of INDIA law and any disputes arising under it shall, subject to the provisions of clause Dispute Resolution above, be determined in the Court of Republic of INDIA at Kolhapur.

Use of Your Personal Data

The Company may use Personal Data for the following purposes:

- To provide and maintain our Service, including to monitor the usage of our Service.

- To manage your Account: to manage Your registration as a user of the Service. The Personal Data you provide can give You access to different functionalities of the Service that are available to You as a registered user.

- For the performance of a contract: the development, compliance and undertaking of the purchase contract for the products, items or services you have purchased or of any other contract with Us through the Service.

- To contact You: To contact You by email, telephone calls, SMS, or other equivalent forms of electronic communication, such as a mobile application's push notifications regarding updates or informative communications related to the functionalities, products or contracted services, including the security updates, when necessary or reasonable for their implementation.

- To provide you with news, special offers and general information about other goods, services and events which we offer that are similar to those that you have already purchased or enquired about unless You have opted not to receive such information.

- To manage your requests: To attend and manage Your requests to Us.

- For business transfers: We may use Your information to evaluate or conduct a merger, divestiture, restructuring, reorganization, dissolution, or other sale or transfer of some or all of Our assets, whether as a going concern or as part of bankruptcy, liquidation, or similar proceeding, in which Personal Data held by Us about our Service users is among the assets transferred.

- For other purposes: We may use Your information for other purposes, such as data analysis, identifying usage trends, determining the effectiveness of our promotional campaigns and to evaluate and improve our Service, products, services, marketing and your experience.

NDNC

You are authorising BIG DIPPER Insurance Brokers (INDIA) Private Limited to override the DND settings to reach out to you over calls, SMS, emails and any other mode of communication. This authorization will override your registry under NDNC. Considering nature of business as when the claims are incurring.

We may share your personal information in the following situations:

With Service Providers: We may share your personal information with Service Providers to monitor and analyze the use of our Service, to contact you.

For business transfers: We may share or transfer Your personal information in connection with, or during negotiations of, any merger, sale of Company assets, financing, or acquisition of all or a portion of Our business to another company.

With Affiliates: We may share your information with our affiliates, in which case we will require those affiliates to honor this Privacy Policy. Affiliates include our parent company and any other subsidiaries, joint venture partners or other companies that we control or that are under common control with Us.

With business partners: We may share your information with our business partners to offer you certain products, services or promotions.

With other users: when you share personal information or otherwise interact in the public areas with other users, such information may be viewed by all users and may be publicly distributed outside.

With Your consent: We may disclose your personal information for any other purpose with Your consent.

Retention of Your Personal Data

The Company will retain Your Personal Data only for as long as is necessary for the purposes set out in this Privacy Policy. We will retain and use Your Personal Data to the extent necessary to comply with our legal obligations (for example, if we are required to retain your data to comply with applicable laws), resolve disputes, and enforce our legal agreements and policies.

The Company will also retain Usage Data for internal analysis purposes. Usage Data is generally retained for a shorter period of time, except when this data is used to strengthen the security or to improve the functionality of Our Service, or We are legally obligated to retain this data for longer time periods.

Transfer of Your Personal Data

Your information, including Personal Data, is processed at the Company's operating offices and in any other places where the parties involved in the processing are located. It means that this information may be transferred to — and maintained on — computers located outside of Your state, province, country or other governmental jurisdiction where the data protection laws may differ than those from Your jurisdiction.

Your consent to this Privacy Policy followed by your submission of such information represents Your agreement to that transfer.

The Company will take all steps reasonably necessary to ensure that Your data is treated securely and in accordance with this Privacy Policy and no transfer of Your Personal Data will take place to an organization or a country unless there are adequate controls in place including the security of Your data and other personal information.

Disclosure of Your Personal Data

Business Transactions

If the Company is involved in a merger, acquisition or asset sale, Your Personal Data may be transferred. We will provide notice before Your Personal Data is transferred and becomes subject to a different Privacy Policy.

Law enforcement

Under certain circumstances, the Company may be required to disclose Your Personal Data if required to do so by law or in response to valid requests by public authorities (e.g. a court or a government agency).

Other legal requirements

The Company may disclose Your Personal Data in the good faith belief that such action is necessary to:

- Comply with a legal obligation

- Protect and defend the rights or property of the Company

- Prevent or investigate possible wrongdoing in connection with the Service

- Protect the personal safety of Users of the Service or the public

- Protect against legal liability

- Security of Your Personal Data

The security of Your Personal Data is important to Us, but remember that no method of transmission over the Internet, or method of electronic storage is 100% secure. While We strive to use commercially acceptable means to protect Your Personal Data, We cannot guarantee its absolute security.

In case of failure by a User of these Terms of the Website, the BIGDIPPERINSURANCE.COM reserves the right to deny access to its website. Assuming you are not in agreement with all or part of the General Conditions set out below, you are strongly advised not to use the Website.

Contacting us

If you have any questions about this privacy statement, the practices of this site, or your dealings with this web site you can contact us at [email protected]

Enforceability Clause

In the event any portion of this Agreement is found to be invalid or unenforceable, the remainder shall remain in full force and effect.

This agreement is in effect as at June 26, 2023.